PreIPO INTELLI™ Weekly Insights | Series 50

Friday, September 22nd 2023 | Volume 1 Series 50 | Instacart IPO, Capsule launches enterprise content creation, and more funding updates.

Hello, it's Friday once more, signaling the week's conclusion, and we're here with the most recent news and updates in the INTELLI™ Newsletter. This week's highlights include Instacart's IPO debut, which initially valued the US-based grocery delivery company at approximately $10 billion, In the realm of content creation, Capsule, a startup with an AI-powered video editing tool, is making its product accessible to the public. This tool aims to boost video production efficiency, claiming a tenfold increase.

The Instacart IPO

Instacart's IPO Overview: Instacart, a prominent US-based grocery delivery and pick-up company, made its debut as a publicly-traded company on September 19. The IPO marked a significant milestone in the company's journey, initially valuing it at approximately $10 billion. During the IPO, Instacart shares were priced at $30 each. On its first day of trading, the stock experienced substantial volatility, opening at its IPO price and surging to a high of $42.95 per share. However, by the end of the trading day, it closed at $33.70 per share, resulting in a valuation of around $11.2 billion.

Investor Support and IPO Process: Leading up to the IPO, Instacart had filed its S-1 document with the Securities and Exchange Commission (SEC) on August 25. This filing marked a crucial step in the company's preparation for going public. Notably, beverage and snack giant PepsiCo committed to investing a substantial $175 million in Instacart's Series A preferred stock. Additionally, other notable investors, including Norges Bank Investment Management, TCV, Sequoia Capital, D1 Capital Partners, and Valiant Capital Management, joined as cornerstone investors, showing strong support for Instacart's IPO.

IPO History and Delay: It's worth noting that Instacart's journey to becoming a publicly-traded company had been in the works for some time. The company originally filed for an IPO with the SEC on May 11, 2021. However, the listing process faced repeated delays due to fluctuations in market conditions and other factors.

Trading Instacart Shares: Trading Instacart shares is a straightforward process, similar to trading shares of any publicly-traded company. To get started, you can open an account or log in if you're already a customer. Once you're set up, use our platform to search for Instacart. Next, specify your position size and set stop and limit levels to manage your trade. Finally, execute the trade. If you're not ready for live trading, you can practice using a demo account to gain experience.

Instacart's Valuation History: Instacart's valuation has seen fluctuations over time. Initially valued at around $10 billion during the IPO, this valuation was significantly lower than its peak of $39 billion during the pandemic and the $24 billion valuation it held in May 2022.

About Instacart: Instacart, founded in 2012 by Apoorva Mehta, a former Amazon employee and serial entrepreneur, is known for its grocery delivery and pick-up services. Customers can conveniently order from various retailers through Instacart's website or mobile app, with personal shoppers responsible for fulfilling and delivering the orders. The company initially received funding of $120,000 through the Y Combinator accelerator program and rapidly expanded by positioning itself as a faster option for grocery delivery compared to competitors offering same-day service. Over time, Instacart secured partnerships with major brands like Whole Foods and PepsiCo.

Instacart's Market Presence: Instacart's significance in the grocery delivery industry is evident from its extensive market presence. According to its S-1 filing, as of 2023, Instacart serves as the technology partner for over 1,400 retailers, covering 85% of the US grocery market. This includes major players like Kroger, Costco, and Albertsons.

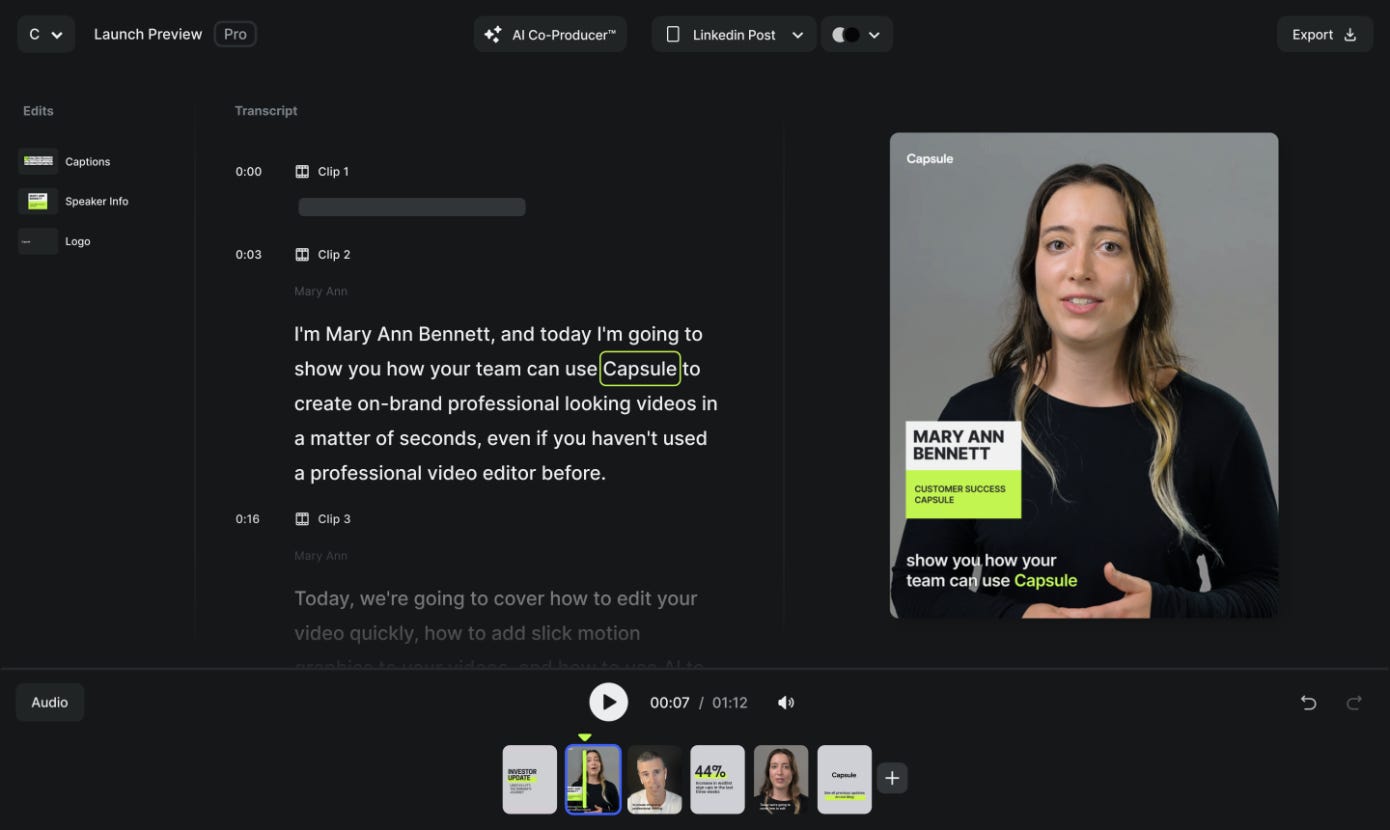

Capsule unveils its AI-driven video editing solution tailored for corporate teams

Capsule, a startup that has dedicated three years to developing its AI-powered video editing tool, is now releasing its product to the public. Instead of aiming to replace human involvement in video editing, Capsule's enterprise-focused AI editor is designed to assist content and marketing teams in producing videos significantly faster, claiming a tenfold increase in efficiency.

Capsule addressed several common pain points expressed by customers, including the challenges of video editing and motion graphics, adherence to strict brand guidelines, and the necessity for collaborative video project work. Typically, these concerns lead to outsourcing video production to professionals.

In contrast, Capsule strives to provide a user-friendly interface similar to popular productivity apps like Notion and Slides, making video editing more accessible. Notably, all video editing occurs directly in the browser, eliminating the need for powerful computer hardware.

The startup has demonstrated capabilities such as selecting text from video transcripts and converting it into title cards or generating images based on entered text prompts. It also enables users to easily choose different caption styles, among other features.

Following a $4.75 million funding round earlier this year, Capsule underwent significant enhancements, introducing numerous new features and performance improvements to assist enterprises in scaling their video production efforts. Users can now incorporate text and motion graphics into their videos without requiring formal editing expertise. They can also leverage AI for tasks such as headline and image generation for B-roll footage.

Capsule relies on its video scripting language, CapsuleScript, which was developed over several years and functions within the browser. All AI model outputs feed into CapsuleScript, which incorporates features such as a layout and animation engine, dynamic expressions, modular components, and support for resolution-independent motion graphics. CapsuleScript is set to open up to the wider community, allowing designers and developers to extend its capabilities.

During its beta testing phase, Capsule engaged with over 160 companies, including HubSpot, Suzy, and Zapier. It has now entered public beta, attracting 10,000 people from its waitlist. For individual business users with a company email, the solution is offered for free, while enterprise pricing is seat-based and aligns with other enterprise creative tools like Figma.

In terms of funding, Capsule has raised $7.75 million from investors, including Bloomberg Beta, Array Ventures, Human Ventures, Swift Ventures, and notable individuals such as Nat Friedman (CEO, GitHub), Amjad Masad (CEO, Replit), Clark Valberg (founder, InVision), Arash Ferdowsi (CTO, Dropbox), Kyle Parrish (head of Sales, Figma), Mike Mignano (ex-Head of Audio & Video, Spotify), Roy Raanani (co-founder, Chorus.ai), and Sahil Lavingia (founder, Gumroad).

Recent Funding Recap 🤝

MotherDuck -$52.5 Million Series B

MotherDuck, a company focused on commercializing the lightweight database platform DuckDB, has secured $52.5 million in a Series B funding round led by VC firm Felicis. This funding brings the startup's total raised capital to $100 million and values MotherDuck at $400 million post-money. The investment will support the expansion of MotherDuck's engineering and go-to-market teams, with the company's headcount expected to grow from 32 employees to 45 by year-end. MotherDuck offers a cloud analytics service based on DuckDB, providing a simplified approach to scaling for analytics that can lead to cost savings and improved performance compared to alternatives like PostgreSQL.

Legit Security - $40 Million Series B

Legit Security, a cybersecurity company founded by former members of the Israel Defense Forces, has raised $40 million in a Series B funding round led by CRV, with participation from Cyberstarts, Bessemer Venture Partners, and TCV. The funds bring Legit's total raised to $77 million, and they will be used to expand the company's sales, marketing, and research and development teams, with plans to increase headcount to over 100 by the end of the year.

Legit was founded to address the shortcomings of traditional app security scanners, which it believes lack broader context and fail to bridge the gap between security, engineering, and DevOps. The company offers a platform that provides real-time visibility and security control across development environments, from code to cloud. It aggregates vulnerabilities from various sources, integrates with existing app security tools, and scores vulnerabilities for risk. Legit can also trace vulnerabilities back to their source code and pipeline, helping companies reduce waste and save costs.

Legit's customers include Google, the New York Stock Exchange, Kraft Heinz, and Takeda Pharmaceuticals. The company's platform is known for its auto-discovery, correlation, and analysis capabilities, which it believes make it stand out in the ASPM market.

Alcion - $21 Million Series A

Alcion, a startup focusing on managing and securing cloud-stored data primarily for Microsoft 365, has closed a $21 million Series A funding round led by Veeam. Despite Veeam being a competitor in data backup and recovery, Alcion CEO Niraj Tolia sees this investment as a vote of confidence in Alcion's growth strategy. Alcion's platform offers disaster recovery, anti-ransomware, anti-malware, and compliance tools. It uses AI models to detect ransomware attacks and provides proactive recommendations for data protection. While there's competition in the data backup and security space, Tolia believes Alcion's unique pricing, focus on security, and AI-driven approach differentiate the company.

The funding will support Alcion's go-to-market efforts and the expansion of its product and engineering teams, aiming to increase its headcount from 21 to 30 people or more by year-end. This investment reflects growing demand for cloud data management and security tools, driven by the challenges organizations face as they shift their operations to the cloud. In 2022, 80% of companies experienced at least one cloud security issue, and 27% suffered breaches with public cloud providers, a 10% increase from the previous year. The enterprise data management market is expected to grow by 12.1% from 2022 to 2030, reaching $89.34 billion in value.

Metaloop - $17 Million Series A

Austrian startup Metaloop has raised €16 million ($17 million) in a Series A funding round for its platform that connects scrap metal sellers with buyers. Metaloop targets industrial entities where scrap metal is a by-product and helps monetize their excess materials. The global scrap metal recycling market was valued at $58 billion in 2021 and is expected to double by the end of the decade. Recycling metals is energy-efficient and reduces greenhouse gases compared to mining. Metaloop serves 600 clients worldwide and aims to address the non-transparent and fragmented scrap metal market by aggregating volumes and providing added services like transportation and financing.

As always, stay tuned for more updates and insights from the team at INTELLI™.