PreIPO INTELLI™ Weekly Insights | Series 55

Friday, October 27th 2023 | Volume 1 Series 55 | Can Plaid help spark the fintech industry, new startup for managing your online info, and more funding updates

Greetings, everyone! It's Friday again, and as the week wraps up, we're here with the latest news and updates in the INTELLI™ Newsletter. This week, we will be discussing Plaid's potential IPO and the recent appointment of their new CFO, reflecting a positive trend in the fintech industry. Additionally, we'll explore I Own My Data (IOMD), a startup revolutionizing online shopping by allowing users to control their data and profiles, eliminating the need for multiple accounts. IOMD recently secured $2.75 million in seed funding from Neotribe Ventures.

Could Plaid's possible IPO signal a turning point for the fintech industry?

Just last week, Plaid introduced Eric Hart, a former Expedia executive, as their new CFO. This decision wasn't entirely unexpected given Plaid's decade-long history, a valuation exceeding $13 billion in 2021, and its ongoing expansion in services and revenue. Interestingly, Plaid is eyeing an IPO, although no specific timeline has been mentioned.

It's worth noting that the company did undergo layoffs of approximately 20% of its workforce late last year. This move, often seen as favorable when preparing for an IPO, can signal a focus on cost management and profit improvement.

Plaid initially started as a firm connecting consumer bank accounts with financial applications but has gradually expanded its offerings to provide a comprehensive onboarding experience. After an almost $5 billion acquisition by Visa was blocked by antitrust regulators, Plaid raised funds at a $13.4 billion valuation and has diversified its revenue streams.

During a recent appearance at Disrupt, Plaid's CEO Zach Perret discussed the company's recent developments but didn't delve into IPO plans, instead welcoming Hart to the team.

For those closely following the industry, this move is seen as a positive development in a sector that has faced challenges of late. Both public and private fintech companies have encountered difficulties, reflected in stock prices and valuations. Plaid's move signals optimism in an industry that, while possibly overhyped in 2020–2021, still boasts robust players. The prospect of Plaid's S-1 filing has many eagerly anticipating the company's next steps.

Ex-PayPal exec's e-commerce startup gives customers control over shopping data

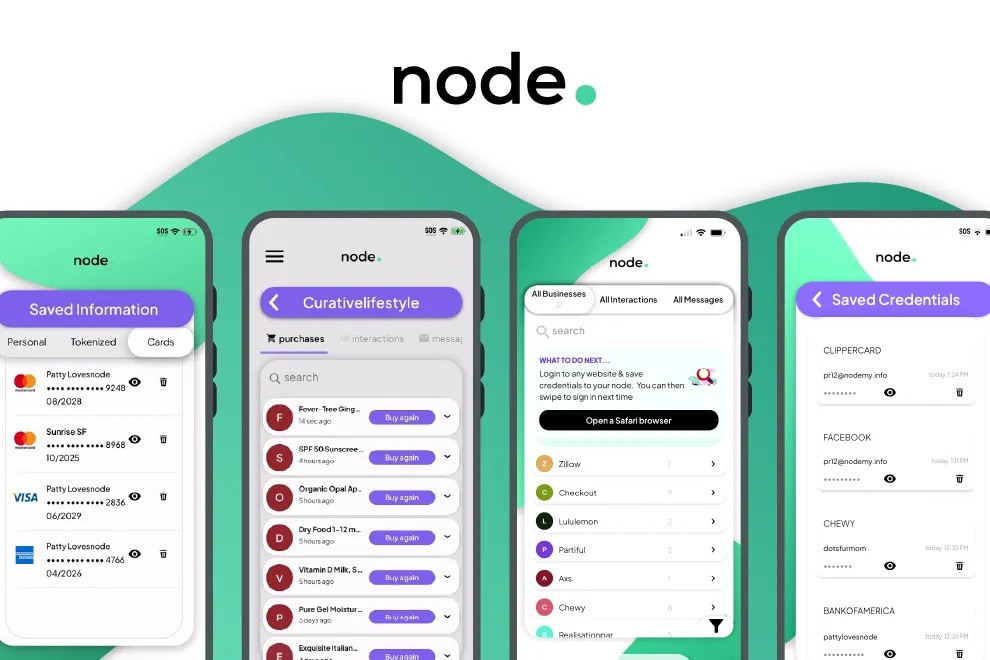

Are you tired of constantly creating new accounts when shopping online? You're not alone. I Own My Data (IOMD), a startup, aims to simplify this process for consumers. By using its Node platform, IOMD allows users to manage and store their online interactions, purchases, and profiles on their own devices, eliminating the need for creating new accounts, passwords, or dealing with promotional emails or texts. This approach enhances the shopping experience and provides a safer and faster way to transact online. Unlike traditional methods that store data on central servers, IOMD keeps all personal information on the user's device, reducing the risk of hacking and phishing. The company recently raised $2.75 million in seed funding, led by Neotribe Ventures, and is focusing on expanding its services to merchants. The funding will support product development and future global expansion. IOMD is not a payments company but an information company, emphasizing data control and user privacy. Node is distinct from single sign-on (SSO) tools, as it puts user data control firmly in the hands of the consumer. Kittu Kolluri, founder and managing director at Neotribe Ventures, believes that Node is poised to transform e-commerce and enhance the shopping experience. As the one-click market becomes increasingly competitive, with significant investments made in this space, Node's approach stands out for its user-centric approach and data security.

Recent Funding Recap 🤝

Mangoboost - $55 Million Series A

The central processing unit (CPU) and graphics processing unit (GPU) have distinct roles in data handling, with CPUs used in various devices and GPUs handling complex tasks. The chip shortage due to COVID-19 has led to the emergence of data processing units (DPUs) to offload communication networking from CPUs and GPUs, reducing costs. MangoBoost, a DPU developer, raised $55 million in funding to optimize data management in enterprises and data centers. Their DPU solution claims to improve performance, reduce power consumption, and cut CPU usage. The funds will be used for product development and expanding their workforce.

Signos - $20 Million Series B

Signos, a startup, is addressing the growing demand for weight loss solutions without pills. They utilize continuous glucose monitors (CGMs) to provide real-time diet and exercise recommendations based on an individual's glucose readings. Signos recently secured $20 million in funding from investors, including Cheyenne Ventures, GV (formerly Google Ventures), and Dexcom Ventures. The company aims to expand its research in metabolic health and its team of 45 employees. Users can select one-month, three-month, or six-month plans, with the six-month plan costing $143 per month. Signos' approach is designed for users serious about their weight loss journey, leveraging long-lasting CGMs for monitoring. The platform not only offers immediate guidance but also educates users about the science behind their metabolism, allowing integration with other health data sources.

Husk Power Systems - $103 Million Series D

Husk Power, a cleantech company, is making significant strides in providing solar mini-grids for rural communities in India and Africa. They recently raised funding in a Series D round to expand their mini-grid fleet. Husk Power's achievements include growing from 12 to 200 solar mini-grids, serving over 10,000 micro, small, and medium enterprises, and avoiding 25,000 tonnes of carbon dioxide. Their future plans include expanding to 1,500 mini-grids across Africa and India, with a focus on Sub-Saharan Africa. Husk Power aims to play a crucial role in achieving universal electrification for 380 million people in Africa by 2030 through their "Africa Sunshot" initiative, with plans to raise $500 million in equity and debt, possibly through an IPO by 2027. While there is competition in the mini-grid space, Husk Power differentiates itself by targeting small villages, maintaining a low levelized cost of energy (LCOE), and employing AI-powered operations.

As always, stay tuned for more updates and insights from the team at INTELLI™.