PreIPO INTELLI™ Weekly Insights | Series 31

Friday, May 5th | Volume 1 Series 31 | Blockchain companies to look out for in 2023, Why interest in Web3 continues to grows among businesses, an overview of the future of the blockchain industry.

📅 Happy Friday to you all - Another week flies by and with this, of course, another round of news and updates brought to you by the INTELLI™ Newsletter. We have some Blockchain companies to watch out for, a quick summary of the the growing interest in Web3, and some more updates that we collected over the weekend.

👁️ Top Growing Blockchain Companies to Keep Your Eye On 👁️

Exploding Topics gave their own list of Top Blockchain Companies to keep an eye on, which we’ve summarized here for you:

Fireblocks - A company that specializes in offering blockchain security solutions to institutions. Their services include assisting clients with cryptocurrency custody, treasury operations, decentralized finance access, and digital asset management. With over 1,000 clients, Fireblocks has secured more than $2 trillion in crypto assets.

Sorare - A platform that leverages blockchain technology to offer a fantasy soccer experience to its users through its gaming arena. The platform also functions as a digital player card marketplace where users can purchase, trade, and sell exclusive limited-edition cards. Sorare has obtained official licensing to issue cards for 280 soccer clubs.

Moonpay - Offers technology solutions to cryptocurrency exchanges and sellers such as Binance, OpenSea, and OKEX. The technology provided allows regular consumers to purchase and sell digital assets using traditional payment methods, commonly known as On-Ramps and Off-Ramps. In late 2021, it was reported that Moonpay had a customer base of over 7 million.

Blockdaemon - A tool for managing nodes, enabling businesses to manage their blockchain applications. The platform currently supports more than 60 blockchain networks.

Texture Capital - A startup that focuses on enhancing the process of raising capital for private companies by utilizing security tokenization. The executive team of the company comprises experienced financial industry professionals who have held positions at renowned firms such as ITG, Liquidnet, and Societe Generale.

Yuga Labs - When they launched in 2021, Yuga Labs were responsible for creating the highly popular Bored Ape Yacht Club NFT collection. Since then, they have evolved into a marketing force in the NFT industry, acquiring the industry-leading Crypto Punks project and branching out into various ventures, including merchandise and metaverse gaming, over the past year.

Zerion - Developed a digital marketplace enabling users to invest in various DeFi projects. The marketplace offers users the convenience of accessing information on DeFi projects, trading them, and monitoring their portfolio, all through a single platform. The marketplace supports more than 60 DeFi projects and boasts over 220,000 monthly active users.

ZenLedger - Offers a range of tax software designed to help retail investors and their CPAs maintain an accurate record of transactions and taxes owed, addressing a major challenge in the world of retail crypto investing. Their software supports over 400 centralized exchanges and over 100 decentralized finance exchanges.

Coinme - Began as a network of Bitcoin ATMs, facilitated by partnerships with CoinStar and MoneyGram. However, they have now launched an app that enables users to purchase and sell cryptocurrencies, with the option of using Mastercard and Visa as payment methods. Their ATMs are widely available nationwide, with over 15,000 locations.

Chainalysis - Aims to bring law and accountability to the unregulated world of blockchain. The startup has created a tool for investigation, compliance, and risk management that assists in solving criminal cases involving cryptocurrency. The tool has been sold to companies in more than 70 countries.

To read more about the stats click here.

📰 Interest in Web3 Grows Among Businesses Despite US Regulatory Challenges

According to a report from Consensus 2023, many businesses are showing interest in Web3 technology despite regulatory challenges in the United States. Web3, which refers to the decentralized web powered by blockchain technology, is gaining traction as more businesses look for ways to decentralize their operations and increase security. While regulatory hurdles remain, many businesses are exploring ways to work within the existing framework or are looking for more favorable regulatory environments. Overall, the report suggests that Web3 is likely to continue to grow and attract interest from businesses in the coming years.

📊 Future of the Blockchain Market

The blockchain technology market is growing rapidly, driven by increasing adoption across various industries such as financial services, healthcare, and supply chain management. The financial services sector is the dominant user of blockchain technology, accounting for over 37% of the global revenue in 2022. The technology is expected to be widely adopted in this sector due to factors such as the rise of cryptocurrencies, rapid transactions, Initial Coin Offerings (ICOs), and reduced total cost of ownership. The healthcare sector is anticipated to grow at the fastest CAGR over the forecast period. However, there are still challenges to widespread adoption, such as regulatory issues, lack of standardization, and limited scalability. Despite these challenges, the blockchain technology market is expected to continue growing rapidly in the coming years.

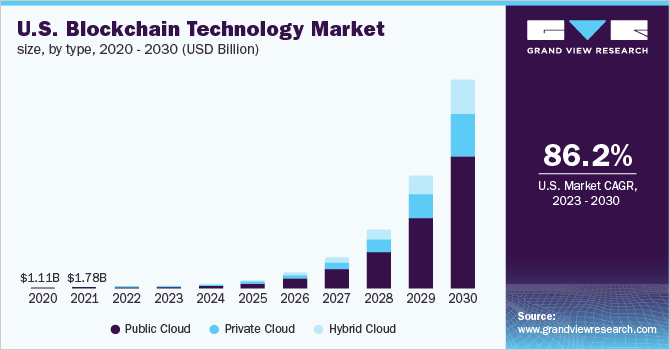

The bar graph in the Grandview report shows the global blockchain technology market size was valued at USD 1.1 billion in 2020 with a CAGR of 86.2% from 2020 to 2030. The graph projects the market size to grow rapidly to reach USD 39.7 billion by 2025 and to continue to grow to USD 1,431.0 billion by 2030. The graph suggests that the blockchain technology market is expected to experience significant growth in the coming years, driven by the increasing adoption of blockchain technology across various industries and the growing demand for secure and efficient transactions.

🔥 INTELLI™ Featured Deals 🔥

This week, we wanted to highlight a few deals that INTELLI™ is tracking.

Quicknode - $60 Million Series B

QuickNode, a blockchain infrastructure provider, raised $60 million in a Series A funding round, led by Sequoia Capital, with participation from other investors. The funds will be used to scale its infrastructure and expand its product offerings. QuickNode aims to become the "AWS or Azure of blockchain," providing a range of blockchain infrastructure services to developers, businesses, and institutions. The company offers a variety of products, including node hosting, API services, and developer tools, and claims to support over 30 blockchain networks. The funding round valued the company at $800 million.

Candy Digital - $38 Million Extended Series A

Candy Digital, a sports-focused NFT company, has raised over $38 million in a funding round led by a group of private investors. The company was founded by Galaxy Digital, Gary Vaynerchuk, and Fanatics founder Michael Rubin.The funds will be used to expand the company's NFT offerings and build out its technology platform. The company has faced internal struggles, with one of its co-founders departing after disputes with the other co-founders over the direction of the company. Despite this, Candy Digital has continued to attract investment and partnerships with major sports organizations, such as the NFL and MLB.

Plai Labs - $32 Million Seed Round

Plai Labs, a new Web3 social platform, has raised $32 million in seed funding led by Coatue and Lightspeed, with participation from several other investors. Plai Labs plans to use the funds to build a decentralized social platform that will enable users to own and control their data and interactions, as well as create and share content. The platform will utilize blockchain technology and non-fungible tokens (NFTs) to allow creators to monetize their content and receive support from fans. Plai Labs also plans to integrate with other Web3 protocols and networks to create a seamless user experience.

As always, stay tuned for more updates and insights from the team at INTELLI™.