⚡️ INTELLI Weekly Insights

Thursday September 29, 2022 | Volume 1 Series 9 | Funding signals, PreIPO opens a new round, August Funding Recap, and a look at CleanTech.

🌅 Good morning - we hope you’ve got your first (or second? third?) coffee already, and are ready to dive into this week’s INTELLI Insight review. A quick few reminders:

The details for our September 30 virtual panel event (tomorrow!) can be found here

PreIPO has shares of MindMaze and Epic Games available. Grab a time slot from our calendar to chat with us regarding the allocation.

PreIPO is raising another $10M in a bridge-to-Series A. Book a time to learn more.

🍁 The first day of Fall (though some of us up in the Northeast felt it long before), September 21, marked the longest the US has gone without any tech IPOs—238 days—in the last century. This recent milestone surpasses previous IPO-less records set in the aftermath of the 2008 financial crisis and the early 2000s dot-com crash.

🔎 August 2022 Funding Recap: INTELLI has hundreds of thousands of data points on entrepreneurs and their management teams in regard to recent funding signals. If you’re interested in getting a copy of this data set, drop us a message. You can grab this set of funding insights to help you get an external view of what’s happening in the market so you can quickly take action, whether it is to connect with your next deal or potential partner.

Quick Facts

Avg Seed Round Size - $3,471,896 (Median: $2,300,000)

Avg Series A Round Size - $20,472,715 (Median: $12,000,000)

Avg Series B Round Size - $41,391,044 (Median: $27,000,700)

Avg Team Size - 456 Employees (Median: 25 Employees)

Largest Seed Deals

AstriVax | $29.9M

Monod Bio | $25M

Fortress Blockchain Technologies | $22.5M

Epigenic Therapeutics | $20M

CreatorDAO | $20M

Largest Series A Deals

Sunwoda Electric Vehicle Battery | $884M

Qiyuan Green Power | $147M

Aktis Oncology | $84M

DeepWay | $67M

Happy Health | $60M

Largest Series B Deals

Viiyong | $294M

Orna Therapeutics | $221M

H2 Green Steel | $190M

SAIC Mobility | $147M

Jinyuansheng | $147M

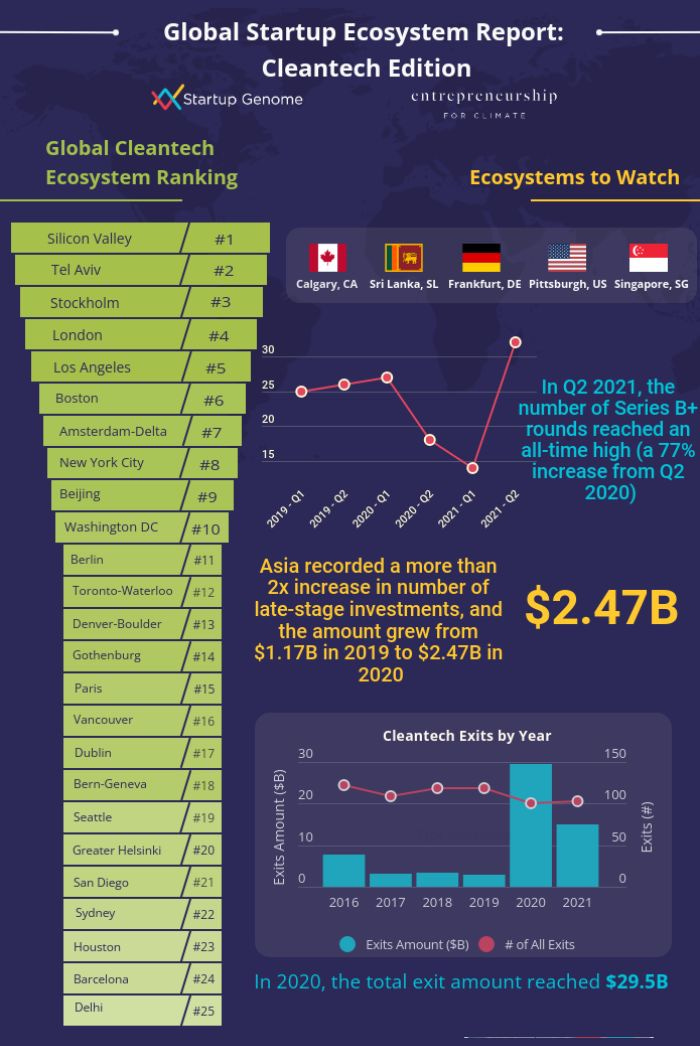

🌿 Cleantech is growing, but it still has a scale-up gap.

Tech startups focused on environmental sustainability and carbon reduction have the highest age at the transaction of any subsector.

On average compared to tech startups across sectors:

→ 3.8 years to Series A - 8 months longer

→ 5.5 years to Series B - 11 months longer

The good news is that deals are on the rise, and the post-money valuation of cleantech companies increased by 176% in 2021.

👀 Something to keep your eye out for:

The White House recently published the “First-Ever Comprehensive Framework for Responsible Development of Digital Assets” outlining what the Biden Administration believes the framework should be for cryptocurrency and digital asset regulation. The document does not include any new legislation and instead aims to guide the financial services industry on borderless transactions and handling fraudulent activity with digital assets.

If you’re interested in getting a copy of this, and other such publications as they come out, let us know by replying here.

💸 The venture capitalist and so-called SPAC King Chamath Palihapitiya is shutting down two technology-focused special purpose acquisition companies, after they failed to find companies to take public, according to TechCrunch in this article.

📆 Lastly, we bring you a short list of three fintech-related events happening around the world:

Oct 4, 2022

London, UK

Dubai

10- 13 Oct 2022

Oct 17-18, 2022

London, UK