🔎 INTELLI™ Datasets & Weekly Insights

Monday, October 31, 2022 | Volume 1 Series 21 | FT1000 Datasets, Predictions, and Updates

🕑☕️ Good afternoon and Happy Monday to all! We’ve recapped the Financial Times Top 1000 companies for you along with some great predictions, news, and updates for you here in our INTELLI™ Newsletter.

So grab your drink of choice and start unwinding today by reading this Newsletter brought to you by our team at INTELLI™.

🚨 FT 1000: The 6th Annual List of Europe’s Fastest-Growing Companies

As published on the Financial Times, “this latest FT-Statista ranking of fast-growing European companies illustrates the changing fortunes of some sectors since the Covid pandemic took hold, in 2020. The companies that made the final cut were sufficiently resilient — and, in some cases, lucky — to survive a collapse in demand caused by coronavirus restrictions, trade frictions due to Brexit, and a long-running global supply chain squeeze.”

Interested in purchasing the list of companies, their management teams & founders, and their contact information from INTELLI™? Over 700+ rows of contact information that you can get from us — send us a message here if you’re interested in a sample!

Top 10 Sectors on the FT1000 List (Count | % Change from Last Yr)

1. Technology (209 | -5%)

2. Construction ( 89 | -6.3%)

3. Retail (86 | +50.3%)

4. E-Commerce (65 | +67%)

5. Support Service (56 | -2%)

6. Health (43 | +72%)

7. Energy (42 | no change)

8. Industrial Goods (36 | -21%)

9. Advertising (33 | +11%)

10. Financial Services (28 | +33%)

Top European Countries on the FT1000 List

1. Italy

2. Germany

3. UK

4. France

5. Spain

6. Poland

7. Sweden

8. The Netherlands

9. Hungary (new entrant in the top this year)

10. Finland

And there are some interesting metrics regarding the leadership personnel of these companies as well.

Some of the prior experiences of these FT1000 CEOs:

Heavy consulting backgrounds…

1. Accenture

2. McKinsey & Company

3. Microsoft

4. The Boston Consulting Group

5. IBM

6. Goldman Sachs

7. EY

8. Freelance / Self-employed

9. Inkitt

10. Templafy

🔮 VC Predictions Weren’t Quite As Expected?

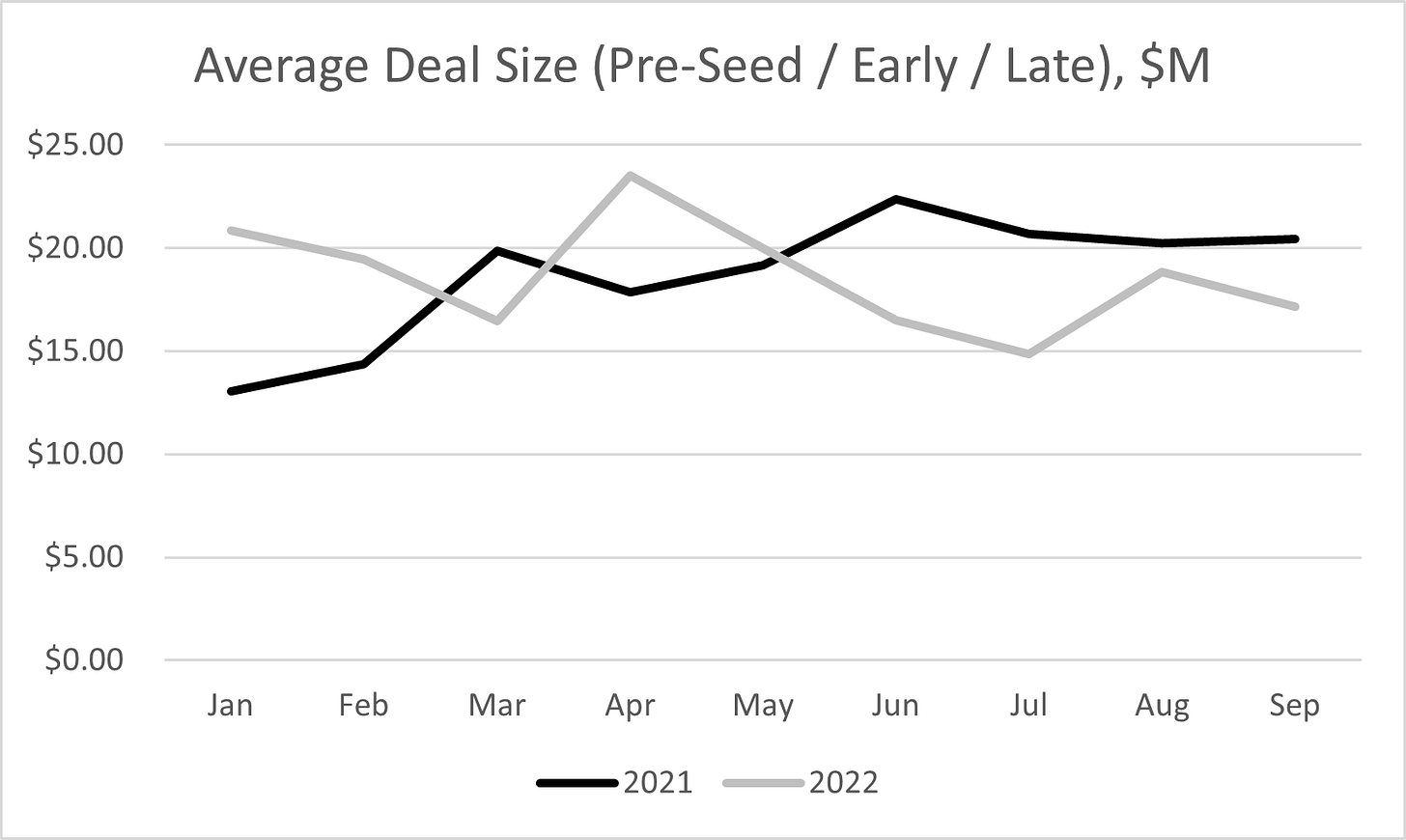

Pre-Labor Day, many predicted a VC funding boom in September. The results from PitchBookData are in, and the predictions did NOT come to pass.

The gap in deal count from the summer persisted in September: the count of deals in 2022 was under what we saw in 2021 at about the same margin as this summer.

The total VC $ raised in September 2022 were -50% off the total raised a year prior, which is down even more down from where we were in August (-43%).

The average VC deal size has also come down since August with the average VC deal in September 2022 -16% to a year prior.

Focusing on results by stage for September 2022 vs 2021:

- Pre-Seed deal count down but avg. deal size up for total raised down 45%

- Early deal count down but avg. deal size up for total raised down 28%

- Late deal countdown and avg. deal size down for total raised down 60%.

All told, the data shows that VC funding continued the summer decline into September. This is consistent with what we saw in public markets in terms of index performance* for September 2022 vs 2021:

- S&P 500: -13%

- EMCLOUD: -49%

What's next? We think deals will increase in Q4 as companies that have put off raising for a while need to come back to the market. And, with the macro and public markets signaling there's further down to go, valuations will decrease further.

*Deals that closed in September may continue to come in over the coming weeks (and months). Further, this data isn't perfect as it only covers reported deals.*

💰 INTELLI™ Featured Investments

Bilt Rewards, a loyalty and credit card app that turns points into rent payments, raised $150 million at a $1.5 billion valuation.

ConnexPay, which provides payment acceptance and issuances in one platform, raised $110 million in growth equity.

Trigo, an Israeli cashierless checkout for brick-and-mortar, raised $100 million.

Floryn, a Dutch provider of small business loans, raised €65 million.

Merge, an HR, payroll, and accounting systems provider, raised a $55 million Series B.

Reap, a Hong Kong-based web3 payments provider, raised $40 million.

The Coterie, a startup providing mass-market access to venture capital, raised $40 million at a $100 million+ valuation.

Moneyhub, a UK open finance and data platform, raised £35 million in equity with a £5 million debt facility.

Finexio, a B2B accounts payable provider, raised a $35 million Series B at a $100 million pre-money valuation.

WeTravel, which provides payment and travel planning tools for companies, raised $27 million at a $100 million valuation.

BMLL, a provider of historical Level 3 data and analytics across global equity and futures markets, raised a $26 million Series B investment round from investors including Nasdaq.

Tymit, a UK buy-now-pay-later provider, raised a £23 million Series A.

[untitled], a yet-to-be-named Southeast Asian fintech startup launched by three ex-Tinkoff execs, raised $16 million.

Center, an expense management software provider, raised a $15 million Series B.

Mattilda, a digital payment platform for Latin America’s private schools, raised $10 million.

Onward, an app for parental and family finances, raised a $9.7 million Series A.

Bookkeep, an accounting automation platform, raised a $6.6 million seed+ round.

Menta, a platform for business financial inclusion in Argentina, Mexico, and Colombia, raised $6 million.

Zulu, a Colombian digital wallet for Latin American users, raised a $5 million seed.

Sidekick, a UK investment management app, raised a £3.3 million pre-seed.

Vixtra, a Brazilian foreign trade finance platform, raised a $3 million pre-Series A.

Dash 2 Trade, a crypto-trading market intelligence platform, raised $500,000 from “hungry investors.”

Klink Finance, a gamified digital asset investing app, raised $500,000.

Wildfire, a white-label rewards program, raised strategic funding from Citi.

Udaan, an Indian platform that connects merchants with working capital, raised $120 million in combined convertible notes and debt at a $3.1 billion valuation.

PhonePe, the Indian digital payments giant, is in talks to raise a $450 to $500 million funding round at a valuation of over $12 billion.

Money View, an Indian digital lender and underwriting app, is in talks to raise a funding round of about $125 million to $150 million at a $1 billion valuation.

💵 Debt Financing

Personal finance app Achieve raised a new debt facility totaling $225 million from UBS.

Small business lender Capital On Tap raised a $110 million revolving credit facility.

Nelo, a Mexican buy-now-pay-later app, raised a $100 million credit facility.

Tune in next time for more updates brought to you by PreIPO INTELLI™